The word "premium" brings many thoughts to mind. Desire, exclusivity, and price occupy a large space in my id, if you will. Like anything else, there's a certain sense of elusiveness to anything we want. Some prefer BMW over Audi, others prefer platinum over gold. In this market, we're at a tipping point where individuals have identified and bought into the brand of smartphone they use on a daily basis. It's not unjustified, but it surely isn't rational. And I expect the premium devices from Apple and Samsung to be at the forefront of the battle for exclusivity, and premiumness.

No matter your preference in smartphone, it's impossible to ignore the build quality of Apple's iPhone. It helped shape the premium smartphone market to what it is today. It has somehow managed to remain a benchmark to every new device. If it wasn't compared to the latest iPhone, it hasn't yet made it to the top-most tier of devices. This is much less an opinion, than it is a characteristic of the smartphone market.

Putting your personal preferences aside, Samsung has managed to garner just as much attention (if not more) than Apple's aging iPhone 5. Where we have seen Samsung perform a minor bump in specifications over the Galaxy S III, including a larger screen, battery, and more powerful processor, Samsung's Galaxy S 4 has filled the void as well as anyone could have asked them to.

However, 2013 is a much different beast than previous years due in part to how high the bar was set in 2012. Last year, we saw just how far manufacturers were willing to go just to get their flagship devices in the hands of every consumer. And at any cost. Google cornered the budget smartphone market with the Google Nexus 4. HTC harbored the best showcase of just how well polycarbonate can be done with the HTC One X. And Apple set the bar in hardware design with the iPhone 5.

But, like I said, 2013 is an entirely different arena, and some manufacturers are about to get a swift kick in the pants with what's in store if they don't react.

If you look back at premium smartphones over the years, we have seen a steady increase in pricing. In my last editorial about the Nexus 5, I pleaded Google to keep the price at a point that allowed the company to have a marginal source of profit per device, and at the same time pack it to the gills with the best specifications. The reason I so desperately desire a smartphone that does not solely market itself based on price is simple.

The first reason is consumer loyalty. No matter your preference in device, if a manufacturer comes along and matches competing hardware features of another device, that consumer's brand loyalty has been reduced. The original manufacturer offering the more expensive device now has two questions to answer for their flagship smartphone: Why does it cost that much? And why is Device A that much better than Device B? Both questions deteriorate the smartphone market, and hurt competition.

Another dilemma the premium smartphone may encounter in the face of lower pricing is irrelevance. Now, this is a hypothetical problem that has not yet happened in the smartphone arena, but I foresee the issue being raised sooner rather than later. A decent example of irrelevance hurting a premium device's reputation is the Apple iPad Mini's success. The iPad Mini has been praised as one of the best medium-sized tablets in the market. With design cues from the iPhone 5, and thinness rivaling paper, it's no wonder the iPad Mini is as desirable as it is.

However, from Apple's perspective, there is a much larger problem at hand. The first is a simple example of macroeconomics. Demand for the iPad Mini, the cheaper and premium mid-range tablet offering from Apple, has exceeded demand of the newest iPad's. To top it off, supply chain manufacturers like Sharp have noted a significant decrease in demand for the 9.7 inch panels used in Apple's flagship "new iPad" line.

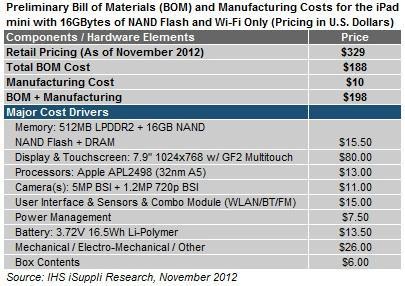

The second problem at hand for Apple with the iPad directly impacts the bottom line. In fact, it is the bottom line itself. The bill of material plus manufacturing cost of the iPad Mini equates to $198. This same 16GB iPad Mini sells for $329 which comes down to a 40% profit. Now, this is nowhere near the profit margin that the iPhone 5 achieves at around 70% per device, but it's a long-term issue that Apple cannot avoid with the iPad Mini due to demand. In the long-run, the iPad Mini is eating away at the profits of the company, and deteriorating sales of its flagship line.

This brings us back to premium smartphones and why they face a dilemma this year. The iPhone 5S, or whatever Apple decides to call their iPhone 5 successor, will be released around June, according to some reports. The iPhone 5S is coming in at an all-time low point for the company. Investors are expecting more than ever, as are consumers. In short, the iPhone 5S might not need to exceed our expectations, but it sure as hell needs to meet them.

The premium smartphone market has much to live up to in 2013, and if rumors of a budget iPhone come to fruition, much of the market's long-term viability lies with Apple. A rumor circling the Apple arena is the launch of a cheap iPhone targeted at emerging markets. Having said this, it would be unwise to bet against Apple selling it stateside, too. You'd also be insane not to bet that it will be priced significantly lower than Apple's premier iPhone model. Oh, and it will probably have a lower profit margin, too.

Like the iPad Mini, a budget iPhone looks set to do two things to the premium smartphone market. The first major impact it will have is decreasing sales of its big brother, the iPhone 5S. Like the iPad Mini, Apple could be inflicting itself with much more internal agony with a premium, budget-friendly smartphone. Lastly, the premium smartphone arena is set to have a wake up call like no other if Apple makes the market think twice about the pricing of smartphones. Most flagship devices come in around $600-$800 off-contract. If an extremely successful device were to come along and question every single device's pricing, the entire market would need to react to remain relevant. Like I said, brand loyalty rides the fine line of irrelevance when competitive pricing upsets the status quo.

In essence, the premium smartphone in 2013 will largely be affected by how much attention the first popular budget smartphone attracts.

As an aside, if you're worried about the iPhone 5's successor dying on arrival, don't be. If there's anything we can learn from Apple's sales of a cheaper alternative to the iPad, it's that Apple is better off sacrificing sales internally (i.e. taking it away from the full-size iPad line), than having consumers purchase competing devices.

In summary, budget devices have a lot going for them, but it won't be at the expense of the premium smartphone market. The premium smartphone faces a tough challenge this year if any manufacturer were to successfully market a budget device with top-tier specifications. I'm quite eager to see how it pans out, starting with the iPhone 5's successor, and its little brother.

Would you buy a competitively priced smartphone with similar features over a flagship device like the Apple iPhone 5S, or Samsung Galaxy S 4? How much power should the price of a smartphone play in its success? Do you think 2013 will be the year we see a change in smartphone pricing? I look forward to talking to you all in the comments below!

Images via Pocket-lint and iSuppli.