After starting its rollout two weeks ago, the Apple Card is now available to everyone in the U.S.

All iPhone owners in the U.S. can now apply for an Apple Card in the Wallet app and begin using it within minutes. "We’re thrilled with the overwhelming interest in Apple Card and its positive reception," said Jennifer Bailey, Apple’s vice president of Apple Pay. “Customers have told us they love Apple Card’s simplicity and how it gives them a better view of their spending.”

Apple also says that it's extending the 3 percent Daily Cash to more merchants today, with Uber and Uber Eats now getting you 3 percent Daily Cash when you pay for those services using your Apple Card with Apple Pay. You also get 3 percent Daily Cash on all purchases made from Apple, including Apple Stores, the App Store, and Apple services. Apple says it'll add more merchants to the 3 percent Daily Cash tier in the coming months.

With Daily Cash, you get a percentage of your purchase back in cash at the end of the day. You'll get 3 percent back on purchases made directly from Apple and from select merchants like Uber when you use Apple Pay. Anytime that you buy anything else with your Apple Card using Apple Pay, you'll get 2 percent Daily Cash. And when you pay for anything using your physical Apple Card, you'll get 1 percent Daily Cash.

Another perk of the Apple Card is that it has no fees. There are no late fees, no over-limit fees, no international fees, and no annual fees.

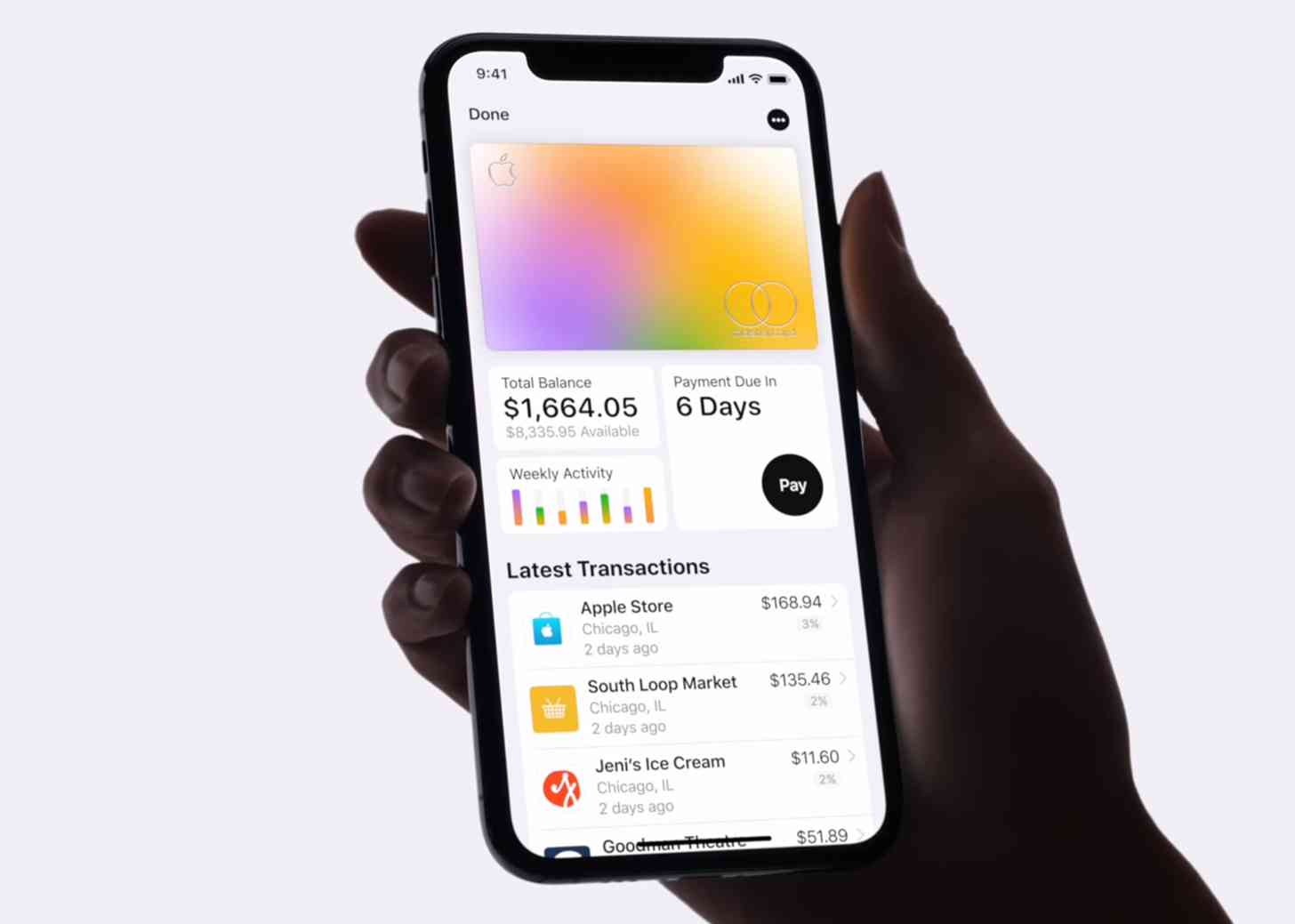

When you have an Apple Card, you'll get a dashboard inside you Wallet app that'll show you all of your necessary info. This includes your balance, when your payment is due, and a real-time list of your transactions with easy-to-understand descriptions. The app uses machine learning and Apple Maps to label your transactions using merchant names and locations. Purchases are also automatically totaled and organized by color-coded categories like Food and Drinks, Shopping, and Entertainment.

When it comes time to make a payment, Apple will show several payment options and calculate the interest cost on different payment amounts in real time. You'll also be able to see how you can make a payment to avoid interest charges.

Finally, there's the physical Apple Card that you can use in places where Apple Pay isn't yet accepted. The card is made of titanium and has no card number, CVV security code, expiration date, or signature to help make it more secure than a traditional credit card. If you need this info for purchase in an app or a website, you can find it within the Wallet app.