I am all for letting my smartphone do everything it possibly can. I use it for all the typical smartphone stuff like emailing, browsing the Web, Facebook, tweeting, taking pictures and notes, etc. I even use it for mobile banking, paying my bills and shopping online. And I'm always looking for more to do with my phone.

For one, I'm dying for NFC payments to finally take off. It's not an overnight process, but things are moving rather slow at the moment. Google is pushing Google Wallet, and several carriers, hardware manufacturers and merchants are backing the ISIS initiative. Yet, nothing major has come of it yet. NFC payments are only accepted at a limited number of stores in various cities and it's only officially available on three phones.

But mobile payments aren't hinging on near field communication. I already use my smartphone to pay for a few things when I leave the house, like Starbucks. No longer do I whip out my debit card or Starbucks card when I order a cup of Joe, I pull out my phone and fire up the Starbucks app and press the Touch to Pay button. And earlier this week, I bought a new case for my iPhone in the Apple store without the help of an employee. I simply picked up the case, opened the Apple Store app, scanned the barcode and walked out with a new case. Pretty neat concept, if I say so myself.

Just this week, during the WWDC keynote, Apple introduced yet another potential threat to NFC: Passbook. The service itself – which will serve as a one stop shop for all your boarding passes, tickets, store cards and coupons once iOS 6 becomes available – is still a bit ambiguous. Instead of pushing NFC, which has a few hurdles of its own, such as hardware requirements on both smartphones and POS systems, Apple is pushing the versatility of QR codes.

Quite frankly, I don't care how mobile payments take off in the end. All I care about is ditching plastic and cash for a more streamlined, frictionless payment system. Mobile payments are finally gaining traction, albeit slowly. But leaving your plastic at home is neither easy nor possible … yet.

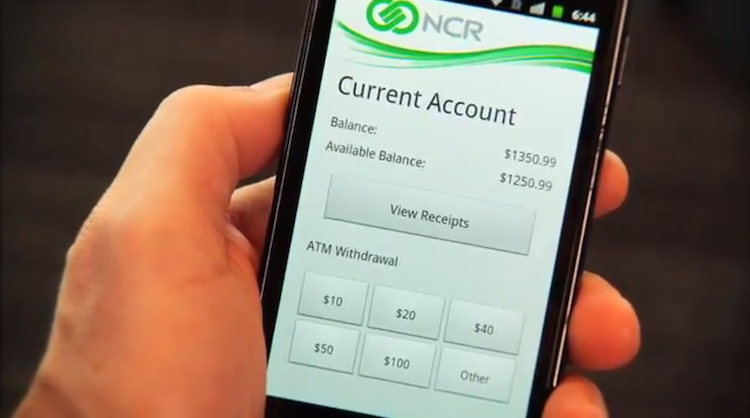

If one firm has a say, though, leaving your debit card at home will soon be one step closer to feasible. NCR's Mobile Cash Withdrawal system allows users to withdraw cash from an ATM with their smartphone rather than a debit card. You start by opening the NCR ATM app on your phone. You are then prompted to enter your PIN and how much money you would like to withdraw. Hit the Scan button to scan the QR code on the ATM and voilà! Your cash is dispensed and you are immediately given an electronic receipt on your phone.

Best of all, this method is noticeably faster than your typical trip to the ATM. Instead of just waiting in line to get to the ATM, you could have your transaction ready to go and simply scan and take your money once the time comes. NCR claims the process can take less than 10 seconds.

But its benefits stretch beyond a faster ATM service; it also offers an extra layer of security. With debit cards, skimming has become an ever-growing issue. You can swipe your card at a seemingly normal ATM and fall victim to hidden cameras and discrete card readers connected to an outside network – that are added by clever thieves to steal information – and never know it. By using your smartphone and never physically swiping anything, that threat is completely averted.

Currently, NCR is "approaching the deployment phase" for its Mobile Cash Withdrawal system and is "seeking partners to pilot this emerging technology", according to the demonstration video. Here's to hoping they can land some major partners and deploy this system STAT.

If it can cut down my time in front of an ATM while adding another layer of security, I'm all for it. And to be honest, I don't see why this system couldn't be expanded and used as a mobile payment system through merchants. NFC is great and all, but the adoption rate is painstakingly slow, no thanks to hardware restrictions.

All I know is the less I have to pull my wallet and debit card out of my pocket, the better. My phone is already in my hand 95 percent of the time, so I might as well pay with it and leave the cards at home.

How do you feel about mobile payments, readers? Do you use your phone to pay for things now? What about NCR's Mobile Cash Withdrawal system? I see it as a much-needed enhancement to current ATMs. I'm all for it, 100 percent. What say you?