Just as rumored, Apple today took the wraps off of its own credit card.

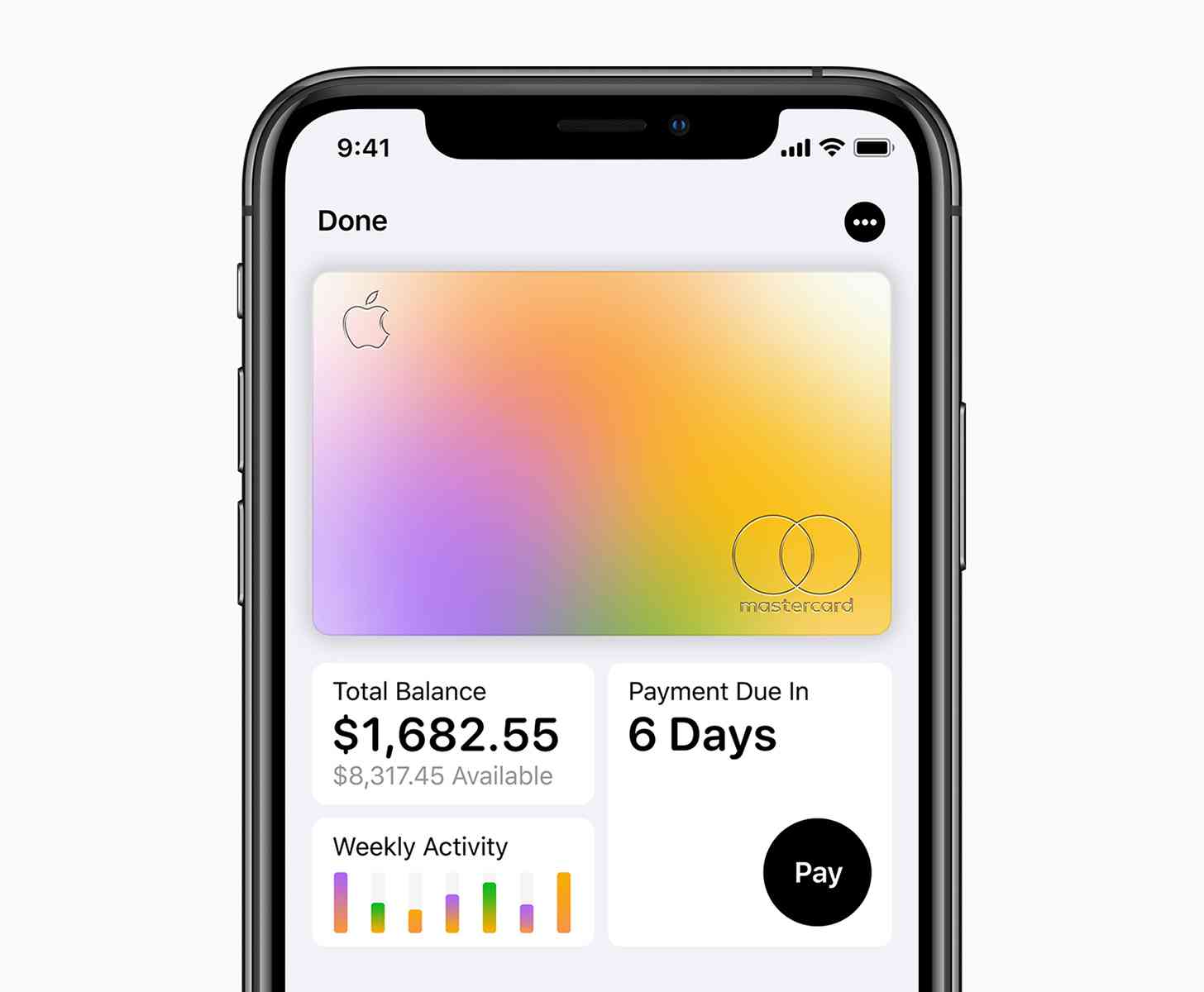

Apple Card is a new credit card from Apple, Goldman Sachs, and Mastercard. You can sign up for an Apple Card on your iPhone, get it within minutes, and use it wherever Apple Pay is accepted. And if you happen to go to places that don't yet support Apple Pay, you can get a physical Apple Card that's made of titanium, has your name laser-etched on it, and has no CVV or card number.

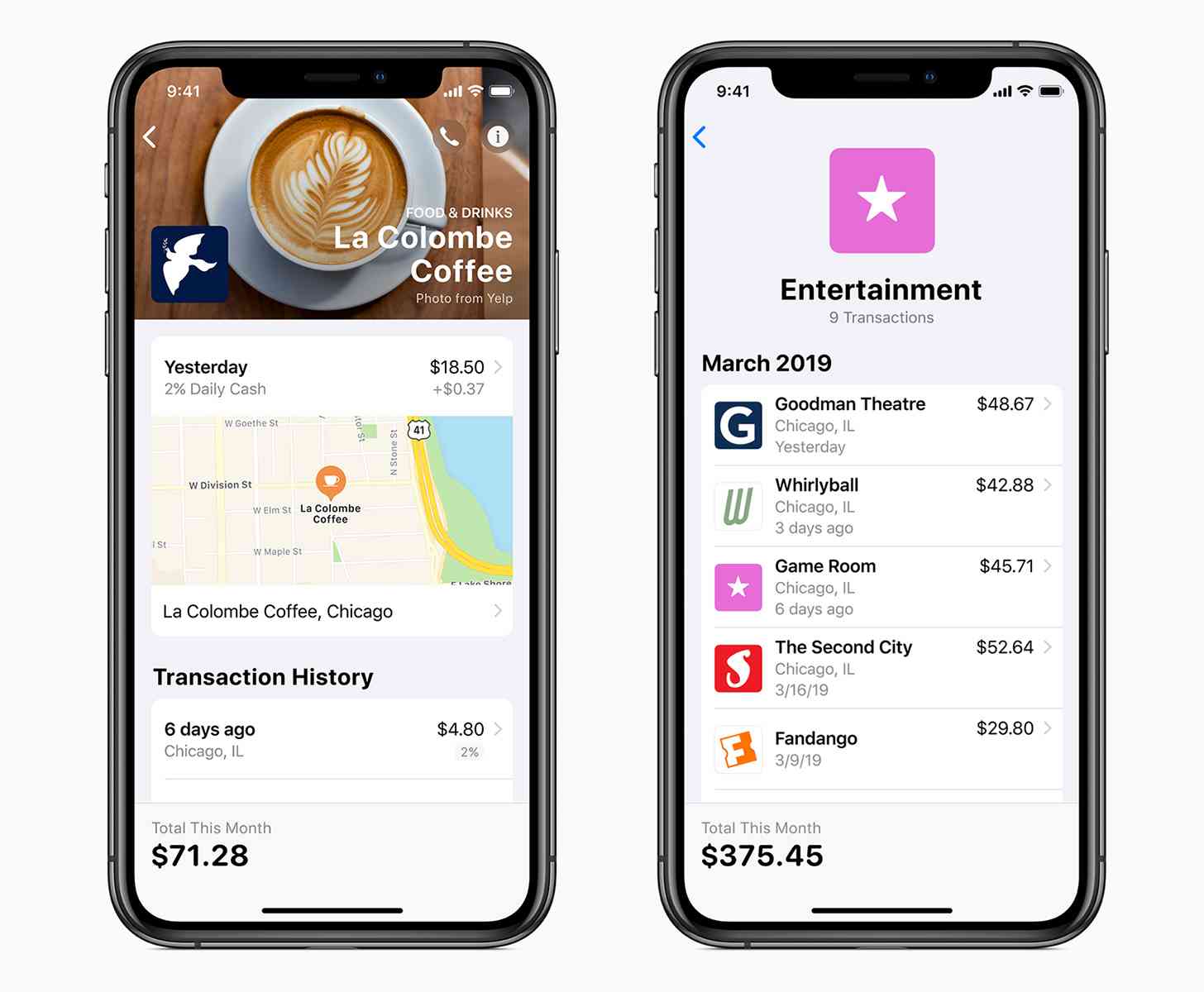

With the Apple Card, you can view all of your info inside the Wallet app, making it easier to see how much you owe, what you spent, and where you spent it. Apple also uses machine learning and Apple Maps to help you see when and where you bought things.

Another major feature of the Apple Card is Daily Cash. This rewards feature will get you money on your Apple Cash card that you can use for other purchases, paying friends, and more. You'll get 2% Daily Cash with purchases made with your Apple Card and 3% on purchases made direct from Apple. You'll also get 1% Daily Cash on purchases made with the physical Apple Card.

Apple says it'll have no fees with the Apple Cash. That includes no late fees, no over-limit fees, no annual fees, and no international fees. Apple also says it's aiming to have lower interest rates with the Apple Card.

The Apple Card is coming to the U.S. this summer. Apple also confirmed today that it's bringing Apple Pay Transit support to Portland, Chicago, and New York City.