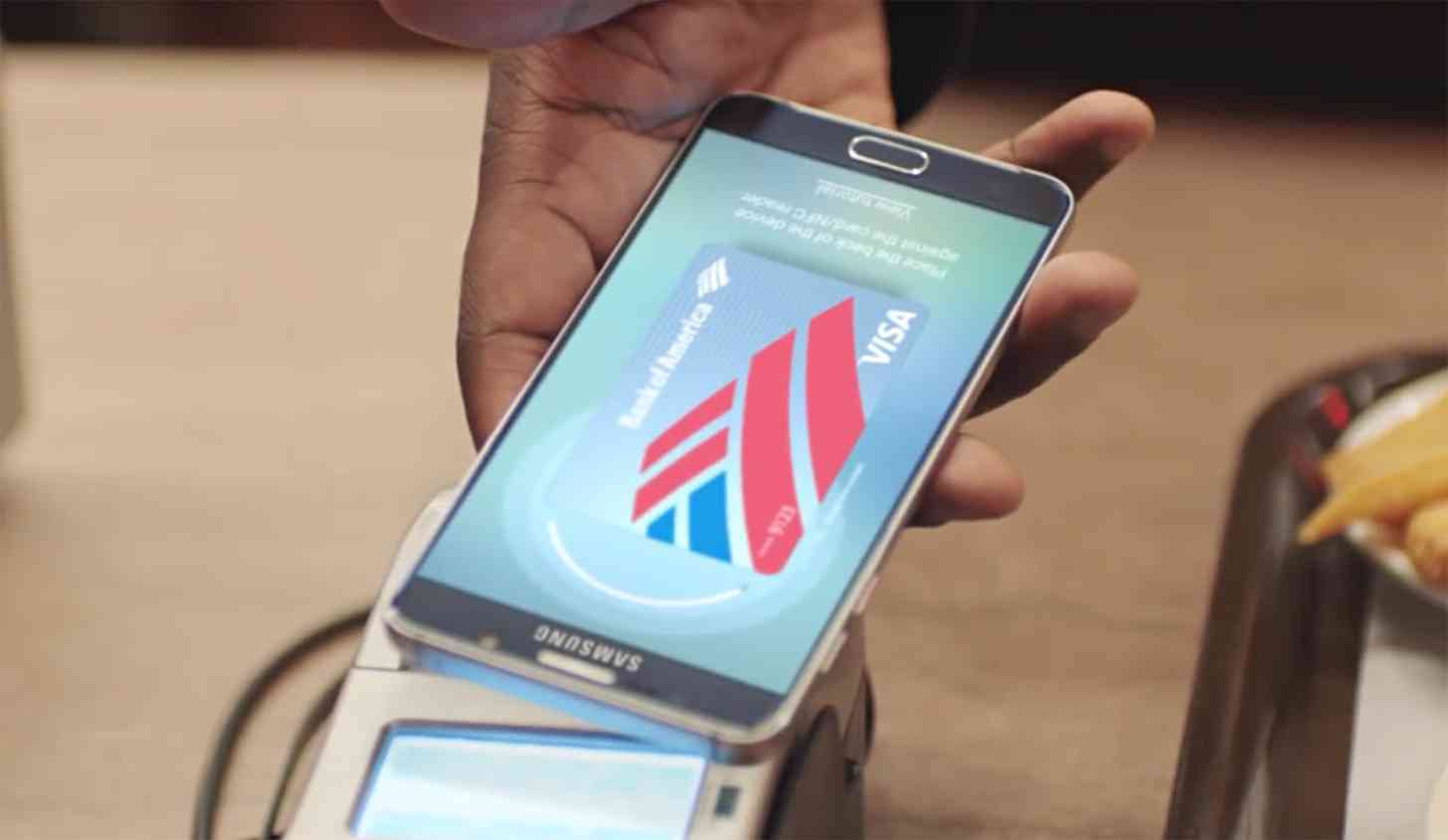

Paying for things with your smartphone is starting to get easier, but not necessarily for the reasons some companies might like. Apple keeps expanding support for Apple Pay in more banks and credit unions, while retail and restaurant rollout is on a much slower trajectory. Google's Android Pay, another major player, still needs to get a lot more attention from banking establishments, but its availability at places to buy things seems to be pretty solid.

There's still a lot of room to grow, but thankfully the companies that want to make mobile payments a thing have laid a stable groundwork. It's adoption that they, and those who want to use their phones (or smartwatches) to pay for things, are waiting for at this point.

Apple, for its part, would very much like it if all those businesses out there, from restaurants to retailers, adopted Apple Pay as the go-to option for customers. Google, I'm sure, is just happy to have a viable alternative (at least for now). But that's not how things are going, it seems. Instead, it's going the "classic route," where mobile payments are dominated not by a single, or even a couple of options, but instead by a whole bunch of them.

Apple Pay wasn't the first, but ever since Apple rolled out its mobile payment option, the market has decided to double down.

The trouble is that most of these options are single-use cases. While Apple Pay, Android Pay, and Samsung Pay, all try to offer use cases at a variety of different locations, things like Walmart Pay just want you to have an option right there in store. But Walmart doesn't want to leave it up to Apple, or Google, or even technically Samsung. They want you to use their thing, too.

Recently it was revealed that Target, another big-box retail chain, is also planning on launching its own mobile payment option. It doesn't have a name yet, but I wouldn't be surprised if it's called Target Pay -- because why not? And, as you might expect, it's another app you're going to need on your phone that already supports Apple or Android Pay.

Apps are ubiquitous at this point, though, so it's probably a safe bet that someone who shops at Target, even on a semi-regular basis, probably has the retailer's app on their phone, too. Integrating a means to checkout, all from the app, probably makes sense to the company.

The question I have is this: Is it better than nothing?

I hate using my cards anymore, even if they are more secure thanks to being chip-enabled. The wait time for the terminal to process the transaction is annoying, and using my phone to pay for something anymore is just a lot easier. Target supports Apple Pay in its iOS app, but apparently the retailer doesn't plan on supporting the mobile payment option in its stores, so maybe launching its own is better than not having it at all.

But that announcement did make me curious. How many different mobile payment options do you have on your phone right now, including the stock one? A quick look at my phone shows that I've got four. Do you have more than one? Do you use all of them on a regular basis? Or are you still not using mobile payments? Let me know!