Finances and yours truly, myself, have never meshed well together. It was a match made in hell. As a child I showed terrible personal finance skills, as many kids do. Instead of saving up for that really cool toy (in my case, a Razor Scooter) I kept spending my small weekly allowance on equally small items like gum, stuffed animals, and candy. As I got older, my allowance wasn’t nearly covering for the things that I was interested in doing or having. Inevitably, I went out and got a job, and I still spent my money rather irresponsibly. I hardly ever set anything aside in my savings despite my parents’ warnings.

Venturing into adulthood was one of the biggest hit-and-miss experiences I think I’ve ever had. I moved out shortly after graduating high school and was somewhat well off at the beginning. Then, at some point, I lost control and my personal finance situation was anything but reliable. So I had to make a few changes; namely, organization.

My first attempt at organization was to get a bunch of folders together and keep bills and other important documents together with them. This worked out well at first, but didn’t necessarily qualify as “smooth sailing” once the months kept passing and I was bad at cleaning up the unnecessary papers. I became less interested in keeping things organized. Although most of the time everything was getting paid on time (it did help a little) I was still missing some bills and payments. I needed a more refined way of organizing things.

At this point I had already gone through a couple of Androids, but it was about this time that I decided to dig deeper than Angry Birds and Bejeweled and utilize my app store for a more important reason – personal finance.

I was lucky in the sense that the very first application I downloaded did two important things that I was lacking in the financial aspect in my life, and that would be organization and budgeting. Although skeptical at first, I found that it was much easier to adapt to updating my finances in the smartphone application than it was to organize folders upon folders of important papers. While of course these financial assistance applications can’t provide you with easy access to every financial aspect of your life, it really did help me cut down the amount of clutter that was haunting my house.

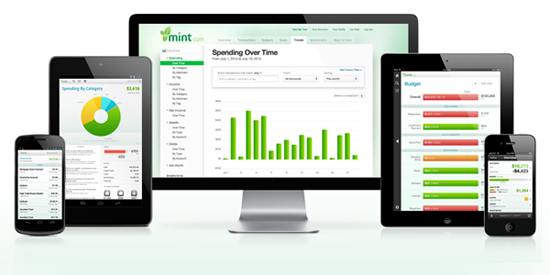

The first financial assistance application I used is called Mint, which the application I still primarily use today. I also stand by the fact that it remains the most intuitive out of all of the applications I have tried. It has provided me the most support from my banking and credit accounts and gives me a good idea of when I should and shouldn’t spend more money. (And yes, sometimes it does feel silly that a smartphone has better control over my spending than I do, but hey – whatever works for some people, right?)

One big issue that I had with Mint, however, was that it didn’t let me add some accounts that weren’t associated with a big commercial company. Some places like smaller credit unions have yet to be recognized by Mint, so trying to get those added in (plus the loans I had through them) left out a piece of the puzzle for me. This led me to try another application to see if it had any option to add in custom banks accounts or loans.

That’s when I came across Manilla. Manilla is a financial application that has a much simpler layout, but not as many features. It allows you to add whatever accounts you want, even if they’re not supported, and also reminds you when to pay your bills. However, it doesn’t help you budget so that’s where Mint.com comes in handy. I frequently switch back and forth between the two for complete support.

Fortunately, through both of these applications I find that I am much more financially stable than I was without them. In the end this really helped reduce stress on my part, and I absolutely love the convenience that these applications are able to provide for us right from our phones. I’ve tried out other personal finance applications and have found that none of them work quite as well for me as these two, but just because they didn’t work out as well for me doesn’t mean they can’t work out better for you!

So readers, do you do personal financing via your smartphone? Why or why not? If so, what are some of your favorite applications? Let me know your thoughts in the comments!

Images via Mint