Now that the third quarter of the year has wrapped up and we're well into the fourth, it's about that time for companies to begin reporting their Q3 2011 earnings. The first U.S. carrier out of the gate with their numbers is AT&T, which just posted its Q3 2011 rundown. During the three-month period ending September 30th, AT&T posted a total revenue of $31.5 billion, a figure that's down $103 million year over year. Net income for the quarter totaled $3.6 billion.

On the subscriber side of things, AT&T is reporting a gain of 2.1 million in its number of wireless subscribers, bringing its total number of wireless subs to 100.7 million. That 2.1 million figure includes 319,000 postpaid adds, 293,000 prepaid, 1.038 million connected devices, and 473,000 reseller adds. Total churn for the quarter finished at 1.28 percent, down from 1.43 percent in Q2 2011.

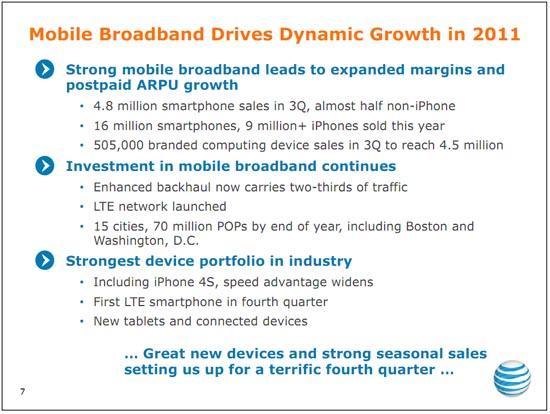

Lastly we've got some device sales stats to throw at you. AT&T reports that it sold 4.8 million smartphones during Q3 2011, which is almost two-thirds of AT&T's total postpaid device sales for the quarter. iPhone activations totaled 2.7 million for Q3. AT&T didn't share Android sales numbers, but it did say that sales of Android devices have more than double year over year. Overall, almost half of all smartphone sales consisted of non-iPhone devices. AT&T says that 52.6 percent of its 68.6 million postpaid customers are now rocking smartphones, a number which is up from 39.1 percent one year ago and 31.1 percent two years ago.

Separately, AT&T has announced that it's activated more than one million iPhone 4S' as of Tuesday, making the 4S the most successful iPhone launch in the carrier's history.

Overall it sounds like AT&T had a decent Q3 2011, dropping a bit in total year over year revenue but seeing a nice jump in subscriber count that's pushed it past the 100 million customer milestone. The figure in AT&T's report that really stands out to me is the number of smartphone-owning postpaid subs, a number that that's jumped 13.5 percent increase in just one year and a whole 21.5 percent in two. We've long-suggested that smartphone adoption is growing rapidly thanks to the fact that the handsets are increasingly becoming cheaper and easier to use, but it's great to see that more than half of AT&T postpaid customers are now enjoying smartphones. Both AT&T press releases are available for your perusal down below.

UPDATE: AT&T has said that it'll be rolling out LTE to 10 markets on top of its initial five before 2011 is up, but it has yet to say which cities will be graced with its new 4G network. It looks like AT&T just outed a pair of the new LTE markets in its Q3 2011 earnings presentation, though, as can be seen below. Both Boston and Washington D.C. are named as part of the 15 cities that'll see AT&T LTE before year's end.

AT&T Reports Solid Earnings, Strong Cash Flow, Robust Mobile Broadband Sales and Improving Wireline Revenue Trends

Dallas, Texas, October 20, 2011

$0.61 diluted EPS compared to $2.07 diluted EPS in the third quarter of 2010 and $0.54 when excluding one-time gains in the year-ago quarter

2.1 million increase in total wireless subscribers to pass 100 million subscribers, with gains in every customer category

Best free cash flow in two years even with higher capital spending

First sequential growth in wireline business revenues in three years

Best wireless EBITDA service margin performance in six quarters

Sales of Android and other non-iPhone smartphones were almost half of 4.8 million smartphone sales in the quarter

Branded computing subscribers (includes tablets, aircards, MiFi devices, tethering plans and other data-only devices) up 505,000, to reach 4.5 million

18.0 percent growth in wireless data revenues, up $857 million versus the year-earlier quarter

11th consecutive quarter with a year-over-year increase in postpaid subscriber ARPU (average monthly revenues per subscriber), up 1.4 percent to $63.69

Total churn improves; postpaid churn stable

Continued growth in strategic business services revenues, up 19.3 percent year over year

Fifth consecutive quarter of year-over-year growth in wireline consumer revenues, driven by AT&T U-verse® services

176,000 net gain in AT&T U-verse TV subscribers to reach 3.6 million in service, with continued high broadband and voice attach rates

19.6 percent growth in wireline consumer Internet Protocol (IP) data revenues to reach half of consumer revenues, driven by continued AT&T U-verse expansion

Note: AT&T's third-quarter earnings conference call will be broadcast live via the Internet at 10 a.m. ET on Thursday, October 20, 2011, at www.att.com/investor.relations.

Consolidated Statements of Income

Statements of Segment Income

Consolidated Balance Sheets

Consolidated Statements of Cash Flows

Supplementary Operating and Financial Data

Reconciliation of EBITDA

Reconciliation of Free Cash Flow

Reconciliation of Annualized Net-Debt-to-EBITDA Ratio

EBITDA and Free Cash Flow Discussions

AT&T Inc. (NYSE:T) today reported third-quarter results, highlighted by solid earnings and free cash flow, continued strong mobile broadband growth and sequential growth in wireline business revenues.

“Mobile broadband growth continues to be robust, execution was strong across the business, and we delivered another solid quarter,” said Randall Stephenson, AT&T chairman and chief executive officer.

“Smartphones, connected devices and tablets all posted impressive gains. Our first LTE 4G markets are up and running with terrific speeds. And we continue to work toward a successful completion of our planned T-Mobile USA merger. The next waves in the mobile Internet revolution represent tremendous growth potential, and we are laying the groundwork required for that future.”

Third-Quarter Financial Results

For the quarter ended September 30, 2011, AT&T's consolidated revenues totaled $31.5 billion, down $103 million, or 0.3 percent, versus the year-earlier quarter.

Compared with results for the third quarter of 2010, AT&T's operating income margin was 19.8 percent, compared to 17.2 percent; operating expenses were $25.2 billion versus $26.2 billion; and operating income was $6.2 billion, up from $5.4 billion.

Third-quarter 2011 net income attributable to AT&T totaled $3.6 billion, or $0.61 per diluted share. These results compare with reported net income attributable to AT&T of $12.3 billion, or $2.07 per diluted share, in the third quarter of 2010, which included one-time gains from a tax settlement and the sale of Sterling Commerce. Excluding one-time gains, earnings were $0.54 in the third quarter a year ago.

Third-quarter 2011 cash from operating activities totaled $10.4 billion, and capital expenditures totaled $5.3 billion. Free cash flow — cash from operating activities minus capital expenditures — totaled $5.1 billion.

Compared with results for the first nine months of 2010, year to date through the third quarter, cash from operating activities totaled $27.2 billion versus $25.4 billion; capital expenditures totaled $14.7 billion compared to $13.7 billion; and free cash flow totaled $12.4 billion versus $11.6 billion.

WIRELESS OPERATIONAL HIGHLIGHTS

Led by continued strong performance in mobile broadband in the third quarter, AT&T continued to grow revenues, add subscribers, increase postpaid ARPU and expand margins. Highlights included:

Subscribers Pass 100 Million Mark. AT&T posted a net gain in total wireless subscribers of 2.1 million, to reach 100.7 million in service. This included gains in every customer category. Net adds for the quarter include postpaid net adds of 319,000. Excluding the impacts of the Alltel and Centennial integration migrations, postpaid net adds were approximately 384,000. Prepaid net adds were 293,000, connected device net adds were 1,038,000 and reseller net adds were 473,000. Third-quarter net adds reflect adoption of smartphones, increases in prepaid and reseller subscribers and sales of tablets and connected devices such as automobile monitoring systems, security systems and a host of other emerging products.

Strong Quarter for Branded Computing Device Sales. AT&T had another strong quarter with branded computing subscribers, a new growth area for the company that includes tablets, aircards, MiFi devices, tethering plans and other data-only devices. AT&T added 505,000 of these devices to reach 4.5 million, an almost 80 percent increase from a year ago. Most of those new subscribers were tablets, with 290,000 added in the quarter, of which more than 35 percent were postpaid.

Total Churn Improves, Postpaid Churn Stable. Total churn declined to 1.28 percent versus 1.32 percent in the third quarter of 2010 and 1.43 percent in the second quarter of 2011. Postpaid churn was 1.15 percent, compared to 1.14 percent in the year-ago third quarter and 1.15 percent in the second quarter of 2011. Excluding the impacts of the Alltel and Centennial migrations, postpaid churn of 1.11 percent for the quarter was unchanged versus the year-ago quarter.

Non-iPhone Smartphone Sales Increase. AT&T continues to deliver robust smartphone sales. (Smartphones are voice and data devices with an advanced operating system to better manage data and Internet access.) In the third quarter, the company sold 4.8 million smartphones, representing nearly two-thirds of postpaid device sales. Sales of Android devices more than doubled year over year, and almost half of all smartphone sales were non-iPhone devices. During the quarter, 2.7 million iPhones were activated/

At the end of the quarter, 52.6 percent of AT&T's 68.6 million postpaid subscribers had smartphones, up from 39.1 percent a year earlier and 31.1 percent two years ago. The average ARPU for smartphones on AT&T’s network is 1.9 times that of the company's non-smartphone devices. More than 85 percent of smartphone subscribers are on FamilyTalk® or business plans. Churn levels for these subscribers are significantly lower than for other postpaid subscribers. The number of subscribers on tiered-data plans continues to increase. About 18 million, or nearly half, of all smartphone subscribers are on tiered-data plans.

Wireless Revenues Grow. Total wireless revenues, which include equipment sales, were up 2.8 percent year over year to $15.6 billion. Wireless service revenues increased 4.3 percent, to $14.3 billion, in the third quarter.

Wireless Data Revenues Lead Growth. Wireless data revenues — driven by Internet access, access to applications, messaging and related services — increased by $857 million, or 18.0 percent, from the year-earlier quarter to $5.6 billion. AT&T’s postpaid wireless subscribers on monthly data plans increased by 16.5 percent over the past year. Versus the year-earlier quarter, total text messages carried on the AT&T network increased by 22 percent to 196.3 billion, and multimedia messages increased by 54 percent to 4.3 billion.

Postpaid ARPU Continues Growth. Driven by strong data growth, postpaid subscriber ARPU increased 1.4 percent versus the year-earlier quarter to $63.69. This marked the 11th consecutive quarter AT&T has posted a year-over-year increase in postpaid ARPU. Postpaid data ARPU reached $25.14, up 14.2 percent versus the year-earlier quarter.

Wireless Margins Expand. Third-quarter wireless margins reflect strong smartphone sales, solid customer upgrade levels and some residual Alltel and Centennial merger costs. This was offset in part by improved operating efficiencies and further revenue gains from the company’s growing base of high-quality smartphone subscribers. Year-over-year comparisons are also influenced by the launch of iPhone 4 at the end of the second quarter a year ago.

AT&T’s third-quarter wireless operating income margin was 29.6 percent versus 23.1 percent in the year-earlier quarter, and AT&T’s wireless EBITDA service margin was 43.7 percent, compared with 37.6 percent in the third quarter of 2010. Without customer migration and integration costs from the Alltel and Centennial mergers, the EBITDA service margin would have been 44.0 percent. (EBITDA service margin is earnings before interest, taxes, depreciation and amortization, divided by total service revenues.) Third-quarter wireless operating expenses totaled $11.0 billion, down 5.9 percent versus the year-earlier quarter, and wireless operating income was $4.6 billion, up 31.7 percent year over year.

AT&T Activates One Million iPhone 4S'

Activations Surpass All Previous Launches; Customers Prefer AT&T Speed Advantage

Dallas, Texas, October 20, 2011

AT&T today announced it activated more than 1 million iPhone 4S’ as of Tuesday, making it the most successful iPhone launch in the company’s history. AT&T was the first carrier in the world to launch iPhone in 2007 and is the only U.S. carrier to support iPhone 4S with 4G speeds.

“It’s no surprise that customers are clamoring for iPhone 4S and they want it to run on a network that lets them download twice as fast as competitors’,” said Ralph de la Vega, President and CEO, AT&T Mobility & Consumer Markets.

AT&T’s speed advantage, and the unique ability to talk and surf at the same time, has been roundly praised by industry pundits.

Additional information can be found at www.att.com/iphone.

*AT&T products and services are provided or offered by subsidiaries and affiliates of AT&T Inc. under the AT&T brand and not by AT&T Inc.

About AT&T

AT&T Inc. (NYSE:T) is a premier communications holding company and one of the most honored companies in the world. Its subsidiaries and affiliates – AT&T operating companies – are the providers of AT&T services in the United States and around the world. With a powerful array of network resources that includes the nation’s fastest mobile broadband network, AT&T is a leading provider of wireless, Wi-Fi, high speed Internet, voice and cloud-based services. A leader in mobile broadband and emerging 4G capabilities, AT&T also offers the best wireless coverage worldwide of any U.S. carrier, offering the most wireless phones that work in the most countries. It also offers advanced TV services under the AT&T U-verse® and AT&T | DIRECTV brands. The company’s suite of IP-based business communications services is one of the most advanced in the world. In domestic markets, AT&T Advertising Solutions and AT&T Interactive are known for their leadership in local search and advertising.

Additional information about AT&T Inc. and the products and services provided by AT&T subsidiaries and affiliates is available at http://www.att.com. This AT&T news release and other announcements are available at http://www.att.com/newsroom and as part of an RSS feed at www.att.com/rss. Or follow our news on Twitter at @ATT.

© 2011 AT&T Intellectual Property. All rights reserved. Mobile broadband not available in all areas. AT&T, the AT&T logo and all other marks contained herein are trademarks of AT&T Intellectual Property and/or AT&T affiliated companies.