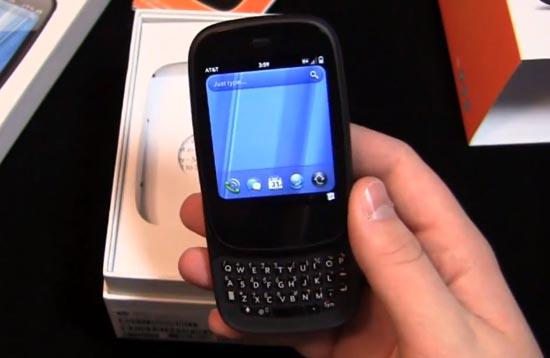

Tough news for webOS fans today, as HP just announced that it will no longer sell hardware based on the mobile operating system that it bought from Palm last year. In a statement that just hit the wire, HP said that it plans to "discontinue operations for webOS devices, specifically the TouchPad and webOS phones." The company went on to say that it will explore its options when it comes to what to do with the webOS software.

To say that today's news caught folks off-guard would be an understatement, and it's definitely disappointing to see webOS stumble like this. It's unclear what this announcement means for the platform going forward, although we've heard talk of HP possibly licensing webOS out to other manufacturers. Perhaps now that Google and Motorola have gotten into bed together, companies like Samsung and HTC may be more interested in using webOS on their devices? We'll see.

UPDATE: HP announced during its earnings call that it plans to shut down its webOS hardware division by Q4 2011. It also touched a bit on TouchPad sales, saying that "the sell-through of the product was not what we expected."

UPDATE 2: According to an HP "insider" speaking to This is my next, webOS GBU VP Stephen DeWitt said today at an all-hands meeting that HP is "not walking away from webOS." DeWitt also indicated that HP is likely planning to license webOS, says the source. When asked about licensing the OS to HTC or Samsung, HP VP Todd Bradley reportedly said that webOS is designed to work with Qualcomm chips and that many potential companies would likely want webOS to work with other kinds of chipsets.

HP Confirms Discussions with Autonomy Corporation plc Regarding Possible Business Combination; Makes Other Announcements

PALO ALTO, Calif.--(BUSINESS WIRE)--HP (NYSE: HPQ) today commented on the recent announcement by Autonomy Corporation plc (LSE: AU.L). HP confirms that it is in discussions with Autonomy regarding a possible offer for the company.

HP also reported that it plans to announce that its board of directors has authorized the exploration of strategic alternatives for its Personal Systems Group (PSG). HP will consider a broad range of options that may include, among others, a full or partial separation of PSG from HP through a spin-off or other transaction.

In addition, HP reported that it plans to announce that it will discontinue operations for webOS devices, specifically the TouchPad and webOS phones. HP will continue to explore options to optimize the value of webOS software going forward.

HP today announced preliminary results for the third fiscal quarter 2011, with revenue of $31.2 billion compared with $30.7 billion one year ago.

In the third quarter, preliminary GAAP diluted earnings per share (EPS) was $0.93 and non-GAAP diluted EPS was $1.10, compared with third quarter fiscal 2010 GAAP diluted EPS of $0.75 and non-GAAP diluted EPS of $1.08. Non-GAAP diluted EPS estimates exclude after-tax costs related primarily to the amortization of purchased intangible assets of approximately $0.17 per share and $0.33 per share in the third quarter of fiscal 2011 and fiscal 2010, respectively.

For the fourth fiscal quarter of 2011, HP estimates revenue of approximately $32.1 billion to $32.5 billion, GAAP diluted EPS in the range of $0.44 to $0.55, and non-GAAP diluted EPS in the range of $1.12 to $1.16. Non-GAAP diluted EPS guidance excludes after-tax costs of approximately $0.61 to $0.68 per share, related primarily to restructuring and shutdown costs associated with webOS devices, the amortization and impairment of purchased intangibles, restructuring charges and acquisition-related charges.

HP estimates full-year FY11 revenue will be approximately $127.2 billion to $127.6 billion, down from its previous estimate of $129 billion to $130 billion. FY11 GAAP diluted EPS is expected to be in the range of $3.59 to $3.70, down from its previous estimate of at least $4.27, and FY11 non-GAAP diluted EPS is expected to be in the range of $4.82 to $4.86, down from its previous estimate of at least $5.00. FY11 non-GAAP diluted EPS estimates exclude after-tax costs of approximately $1.16 to 1.23 per share, related primarily to restructuring and shutdown costs associated with webOS devices, the amortization and impairment of purchased intangibles, restructuring charges and acquisition-related charges.

HP will host a conference call with the financial community today at 2 p.m. PT / 5 p.m. ET to discuss these announcements well as HP’s third quarter 2011 financial results. The call is accessible via an audio webcast at www.hp.com/investor/2011q3webcast.

About HP

HP creates new possibilities for technology to have a meaningful impact on people, businesses, governments and society. The world’s largest technology company, HP brings together a portfolio that spans printing, personal computing, software, services and IT infrastructure at the convergence of the cloud and connectivity, creating seamless, secure, context-aware experiences for a connected world. More information about HP is available at http://www.hp.com.

Use of non-GAAP financial information

To supplement HP’s consolidated condensed financial statements presented on a GAAP basis, HP provides non-GAAP operating profit, non-GAAP operating margin, non-GAAP net earnings, non-GAAP diluted earnings per share and gross cash. HP also provides forecasts of non-GAAP diluted earnings per share. A reconciliation of the adjustments to GAAP results for this quarter and prior periods is included in the tables below. In addition, an explanation of the ways in which HP management uses these non-GAAP measures to evaluate its business, the substance behind HP management’s decision to use these non-GAAP measures, the material limitations associated with the use of these non-GAAP measures, the manner in which HP management compensates for those limitations, and the substantive reasons why HP management believes that these non-GAAP measures provide useful information to investors is included under “Use of Non-GAAP Financial Measures” after the tables below. This additional non-GAAP financial information is not meant to be considered in isolation or as a substitute for operating profit, operating margin, net earnings, diluted earnings per share, or cash and cash equivalents prepared in accordance with GAAP.

Forward-looking statements

This news release contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of HP may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to any projections of revenue, margins, expenses, earnings, tax provisions, cash flows, benefit obligations, share repurchases, currency exchange rates, the impact of acquisitions or other financial items; any statements of the plans, strategies and objectives of management for future operations, the exploration of strategic options for PSG and the execution of cost reduction programs and restructuring and integration plans; any statements concerning the expected development, performance or market share relating to products or services; any statements regarding current or future macroeconomic trends or events and the impact of those trends and events on HP and its financial performance; any statements regarding pending business combination transactions; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the impact of macroeconomic and geopolitical trends and events; the competitive pressures faced by HP’s businesses; the development and transition of new products and services and the enhancement of existing products and services to meet customer needs and respond to emerging technological trends; the execution and performance of contracts by HP and its suppliers, customers and partners; the protection of HP’s intellectual property assets, including intellectual property licensed from third parties; integration and other risks associated with business combination and investment transactions; the hiring and retention of key employees; assumptions related to pension and other post-retirement costs; expectations and assumptions relating to the execution and timing of cost reduction programs and restructuring and integration plans; the possibility that the expected benefits of pending business combination transactions may not materialize as expected or that the transactions may not be timely completed; the resolution of pending investigations, claims and disputes; and other risks that are described in HP’s Annual Report on Form 10-K for the fiscal year ended October 31, 2010 and HP’s other filings with the Securities and Exchange Commission, including HP’s Quarterly Report on Form 10-Q for the fiscal quarter ended April 30, 2011. As in prior periods, the financial information set forth in this release, including tax-related items, reflects estimates based on information available at this time. While HP believes these estimates to be meaningful, these amounts could differ materially from actual reported amounts in HP’s Form 10-Q for the quarter ended July 31, 2011. In particular, determining HP’s actual tax balances and provisions as of July 31, 2011 requires extensive internal and external review of tax data (including consolidating and reviewing the tax provisions of numerous domestic and foreign entities), which is being completed in the ordinary course of preparing HP’s Form 10-Q. HP assumes no obligation and does not intend to update these forward-looking statements.

© 2011 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. HP shall not be liable for technical or editorial errors or omissions contained herein.

Via This is my next