For a while, there was an ongoing debate over how successful the tablet market really was. Sure, Apple is selling gobs of iPads, but once you exclude that product, is there actually a tablet market? I guess the question was (or is), do people want a tablet or do they just want an iPad?

The Amazon Kindle Fire was supposed to put that question to rest and show how established the tablet market is. Most analysts agreed: the price, features, and ecosystem would be too much to resist and Amazon would sell tons of them. And so far as we know, they have. But did Amazon just catch lightning in a bottle? It's the same question as before, only with a different product. Do people want a tablet or do they just want…a Kindle Fire? Does the Fire's apparent success mean that other Android tablets now have a chance? Or is it just the 'iPad' of Android tablets - people don't necessarily feel that they need a tablet, they just want the Fire?

In order to find out if the Kindle Fire is the 'iPad' of Android tablets, we have to be able to compare its sales to the sales of other Android tablets. The problem is, companies are a little sheepish about releasing these numbers. (Go figure.) While it may be impossible to know exactly how many units Samsung, Asus, Motorola, and other manufacturers are selling, we can get some pretty good estimates. Here are few I came up with.

- In October 2011, Andy Rubin said that there are 6 million Android tablets out there, excluding "unofficial" tablets like the Nook Color and of course any tablet that has since been released. Amazon lists 636 items as "Android tablets". We'll take away a few of those for the "unofficial" tablets and new releases. We'll filter the remaining into a list of those that have a rating of four stars or more, just to make sure that we have the best and most popular tablets. (Obviously, the numbers will now be slightly skewed in favor of the remaining tablets, but we'll just give them the benefit of the doubt.) The number then becomes about 120. When you divide 6 million by 120, you arrive at 50,000 - a rough estimate of the average number of units sold per model. That's not a lot. (It would be even less if we factored in the entire 636.)

- How about a more generous estimate? In Google's fourth quarter earnings call in January, the company announced that 250 million Android devices have been activated. According to Google's February distribution numbers, devices running Android 3.0 or above (minus version 4.0 since we haven't seen any tablets running Ice Cream Sandwich yet) account for 3.4% of all Android devices, which is about 8.5 million devices. Again, if we take the 120 top-rated tablets listed by Amazon and divide that into 8.5 million, we arrive at 70,833 average units sold per model. That's prettier, but it's still not looking great for the Android tablet market.

- Let's be even more generous. Google also provides distribution numbers by screen size. Devices with an "xlarge" display, that is, 7-10 inches, account for 4.8% of all Android devices. You know the drill - 4.8% of 250 million equals 12 million; 12 million divided by 120 equals 100,000 average units sold per model.

These are in no way scientifically accurate numbers, but they're pretty good estimates considering the amount of information, or rather the lack thereof, available. The worst estimate was 50,000 units sold of each model and our kindest estimate was 100,000 units sold of each model. How many Kindle Fires have been sold?

Roughly 5-6 million, according to analysts. Yeah.

The Kindle Fire dominated the Android tablet market. But why? Again, we go back to our original question: Did people buy the Kindle Fire because they wanted a tablet or did they buy it simply because they wanted the Kindle Fire specifically?

One thing that supporters of the Kindle Fire say contributes to its success is the price. Sure it may not have as many features as the iPad 2 or the Galaxy Tab 10.1, but for 200 bucks, it's hard to say 'No' to. If this is the case, then it would stand to reason that other high-quality tablets in the same price range would do just as well as the Fire. What do the numbers show?

Again, it's hard to tell since manufactures have some aversion to releasing solid sales numbers and the estimates I arrived at earlier can't exactly be broken down by price range. (Amazon's pricing filter is highly skewed due to Used item prices and Sale prices.) There is one other way we can determine a device's popularity: Google Trends.

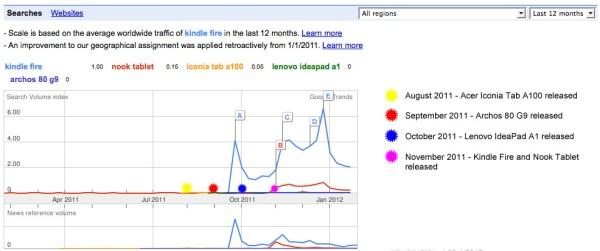

Let's look at four high-quality, popular Android tablets in the same price range as the Kindle Fire, we'll say under $300. We'll refer to their original price, not sale price so products like the BlackBerry PlayBook and HTC Flyer won't be considered though they are now priced at about $200. We'll look at the Nook Tablet ($250), Acer Iconia Tab A100 ($250-$330), Lenovo IdeaPad A1 ($250), and Archos 80 G9 ($300). If a low price really is all it takes to sell a tablet then the popularity of these products should be the same as the Kindle Fire. How did they fare? See the chart below provided by Google Trends with a few extra annotations made by me.

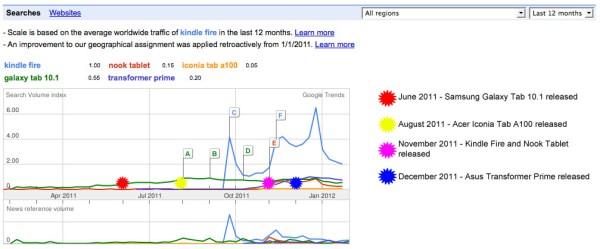

As you can see, despite this chart including the months where these other tablets were released and the fact that they too are affordable and even ship with a more robust version of Android with more features than Amazon's tablet, the Kindle Fire still dominated the search traffic. How dramatic is this dominance? Consider the chart below that covers the same period of time but compares search trends for the iPad 2 along with the Samsung Galaxy Tab 10.1, Asus Transformer Prime, Toshiba Thrive, and Samsung Galaxy Tab 7.7, the best selling Android tablets according to Best Buy and Amazon. The Kindle Fire's dominance over the cheap Android tablet market is just as extreme as the iPad 2's dominance of the high-end tablet market.

Even when you compare two popular cheap Android tablets, two popular high-end Android tablets, and the Kindle Fire, the Fire still dominates in search popularity.

The evidence is clear. The Kindle Fire is to the Android tablet market what the iPad is to the entire tablet market. Price doesn't matter. Features don't matter. If that were the case, people would have bought the Iconia Tab A100 or the Lenovo IdeaPad A1 with an optimized version of the OS, the full Android Market, and more hardware features for fifty bucks more than the Fire.

The moral of the story is that TABLETS aren't necessarily selling well. The iPad and Kindle Fire are, but other tablets are not. Apple sold 12 million iPads in the last few months of 2011. Samsung has sold, by our most generous estimate, 100,000 Galaxy Tabs in its entire existence. Amazon has sold possibly 5-6 million Kindle Fires since its November 2011 release. Again, other manufacturers of high-quality, inexpensive tablets have sold maybe 100,000 units.

So, the question we asked was, Do people actually want a tablet or do they just want the iPad or the Kindle Fire? For the time being, I'd say people just want the iPad or the Kindle Fire. Sorry Samsung, Motorola, Asus, and all you other guys.